I’ve always had a soft spot for Red Robin. The “Dirty Bird” was an affordable step-up from fast food and still felt like a comfortable landing spot for a group of raucous theatre kids to celebrate a birthday. I’m not sure when it happened, but eventually, the food didn’t taste as good and the service felt stilted. I thought it was just me getting older and outgrowing a childhood favorite.

It turns out that Red Robin actually went through a corporate identity crisis and lost a lot of its charm while chasing better investor outcomes. Over the last two years, their leadership team has pushed hard to get them back on track, but is it enough?

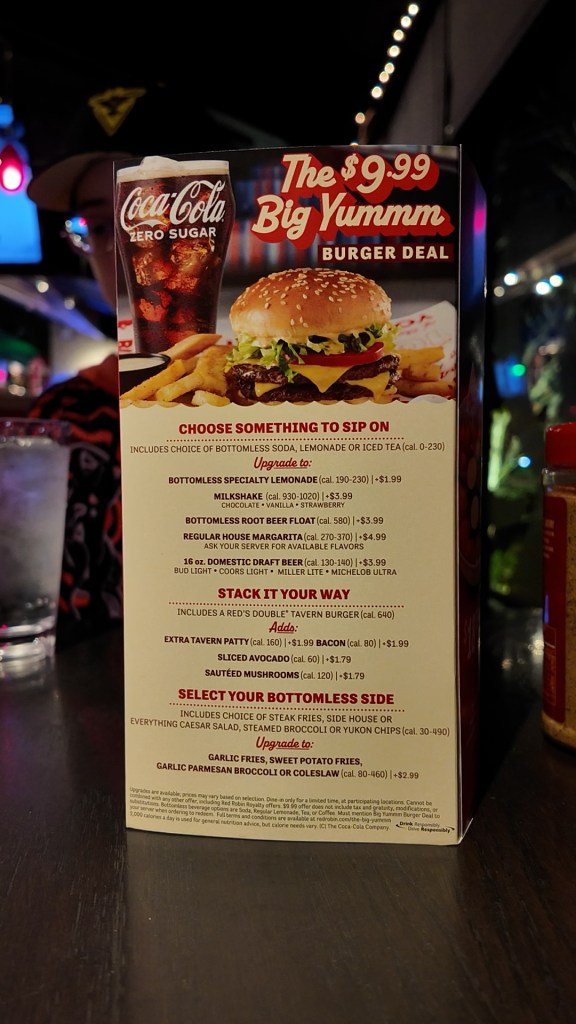

I recently went back to check out their new $9.99 Big Yummm Deal and their line of “Fizzy Sodas” (which I’m unofficially renaming the Dirty Bird Sodas). I’ll provide my reviews of those menu changes below, but I’ll also sprinkle it with my analysis of their corporate filings and whether I think the turnaround strategy will work.

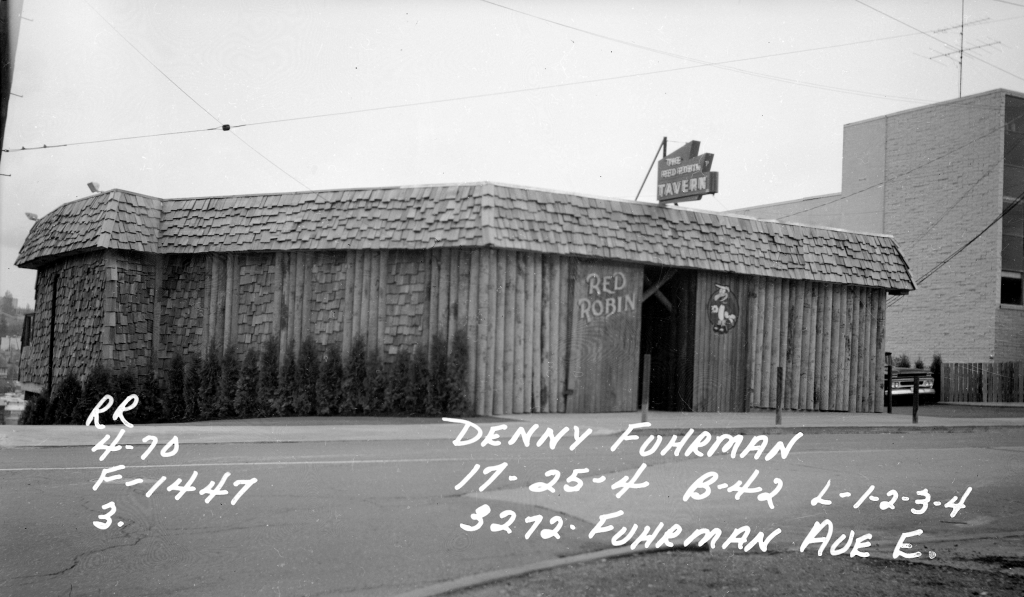

The History: From Barbershop Quartets to Corporate Transformations

Red Robin actually started in 1969 as Sam’s Red Robin Tavern in Seattle. The owner, Sam, was in a barbershop quartet and loved the song “When the Red, Red Robin (Comes Bob, Bob, Bobbin’ Along).” They started franchising in the late 1970s and thenwent public in 2002.

Somewhere along the way, Red Robin shifted from being a casual restaurant with personality to a large-scale “Fast Food+” chain. The food quality went down, service positions were cut, and the brand struggled to articulate a clear value against regular fast-food chains and direct competitors like Applebee’s and Chili’s.

For decades, they used Nieco conveyor-belt broilers. It was consistent and fast, but at the sacrifice of moisture and a good sear. As part of their North Star Plan, they spent millions to rip those out and replace them with flat-top grills. I personally stopped visiting Red Robin because of the decreased quality of the burgers, so I was very curious to see how much of a difference this would make.

Burger Review: I visited twice over a span of about a month. On my first visit, I ordered a gourmet burger, and on the second, the $9.99 Big Yummm Burger Deal. They were both delicious. The Jalapeño Heatwave Burger had a terrific sear and reminded me of Red Robin from the 90s. The Red Double burger in the Big Yummm meal was obviously smaller, but the two thin patties were well-seasoned and, most importantly, they weren’t dry. In my opinion, the flat-top grill produces an exponentially better burger.

📊 CPA Side-Bar: The Cost of a Crust

To fund those new grills, Red Robin executed a series of sale-leaseback transactions, selling the land under their restaurants to generate immediate liquidity. From an accounting perspective, they traded Depreciation for Rent Expense.

Normally, this makes the financials look worse. However, Red Robin’s 86% YoY Adjusted EBITDA growth ($31.2M to $58M measured YTD as of Q3 2025) shows they are outrunning their own new rent expenses. They’ve essentially traded "dead" equity in real estate for a better-tasting asset that drives top-line sales.

The $9.99 “Big Yummm” vs. The Value Wars

Red Robin’s new First Choice strategy (under CEO Dave Pace) is all about traffic. The $9.99 Big Yummm deal (Double Tavern Burger, Bottomless Side, and Bottomless Drink) is a direct shot at the “Value Wars.” It’s “Traffic Bait.”

Even without a direct comparison to Chili’s or Applebee’s, I’m confident saying that the Big Yummm deal is phenomenal value. The burger alone would cost about $10 at a fast-food joint, but here you get bottomless fries and a drink.

Fry Review: Personally, I think the steak fries are the weakest part. I measured them at 7mm on the skinny side and almost 20mm on the wide side, and that’s a lot of potato to cook through. Mine were served at 140°F but were still a bit limp and starchy. My guess is they’re overloading the fryer. Next time, I’m tempted to swap them for the bottomless salad or steamed broccoli.

📊 CPA Side-Bar: The Cost and Opportunity of a Loss-Leader

While the $9.99 price point puts pressure on the Per Person Average (PPA), the brand is offsetting this with massive labor efficiency. This is a "Labor Paradox": they made the kitchen less automated by switching to manual grills and adding back bussers, yet they improved restaurant-level operating margins by 250 basis points (13.1% vs 10.6% in 2024).

Beyond the kitchen, the turnaround is fueled by two major cost shifts:

Advertising Pivot: They slashed expensive national TV ads by nearly 50%, moving those dollars to targeted digital campaigns for their 14-million-member loyalty program.

G&A Reduction: They trimmed corporate overhead by roughly 19% YoY, focusing those resources back into the restaurants through the Managing Partner program. This rewards location managers for hitting both profitability targets and guest satisfaction scores—proving that you don’t have to sacrifice service to fix the P&L.

The “Dirty Bird” Fizzy Soda Gauntlet

The name “Fizzy Soda” is ridiculous, but “Dirty Sodas” offer a lot of novelty with a high margin. Red Robin takes a standard soda, adds flavored syrup, and tops it with creamy cold foam. They used to serve “Cream Sodas” that had whipped cream on top, but I actually think that the cold foam is a big improvement. It settles into the glass faster and incorporates more naturally. Better than whipped cream, and better than half-and-half.

I upgraded my Big Yummm meal for $1.99 to get bottomless Fizzy Sodas and was determined to get my money’s worth. Here’s my comprehensive ranking:

- Vanilla Dr Pepper (8.6): The creamy foam and vanilla rounded out the Dr Pepper spices perfectly.

- Coconut Coca-Cola (7.8): A slightly tropical vibe that doesn’t overpower the cola.

- Dragon Fruit (7.5): In Sprite. Tasty, but very sweet; it needs a good mix.

- Candied Orange (7.3): Tastes like an orange creamsicle. I don’t hate it.

- Desert Pear (5.4): Too subtle. It just tasted like cream and sugar.

- Wild Raspberry (4.7): Tasted like a melted snowcone. Easily the worst of the bunch.

The Verdict: Is the Bird Back?

Red Robin has been struggling financially, but these strategic moves are interesting. They expect to close between 50 to 70 underperforming stores over the next few years to focus on the winners.

My recent visits reminded me of Red Robin from the 90s. It wasn’t just nostalgia, the food was legitimately food again. If they can fix the fries and keep up the service levels, I’d love to see the Dirty Bird fly again.